Why Guessing Your CAC Is A Losing Strategy

Let's be honest for a second—a lot of businesses fly blind with their marketing spend. They pour money into different campaigns, cross their fingers, and just hope for the best, all without a firm grasp on the actual return. This "spray and pray" approach is a dangerous game, especially today.

Relying on rough estimates or gut feelings about your Customer Acquisition Cost (CAC) just doesn't cut it anymore. In today's market, precision is everything. If you don't know your exact CAC, you're essentially gambling with your marketing budget. You have no real way of telling which channels are profitable and which are just financial black holes.

The Real Costs Behind Your Customer Acquisition

Here are the essential sales and marketing expenses you must include for an accurate CAC calculation.

Marketing salaries include full-time salaries, part-time wages, and contractor fees for your marketing team. For example, this could be the prorated monthly salary of your PPC specialist.

Sales salaries cover the salaries and commissions for your sales development representatives and account executives. An example is the base salary plus commission paid to a sales rep for closing deals.

Ad spend refers to the total amount spent on paid advertising across all platforms. For instance, this could be your monthly budget for Google Ads, Facebook Ads, or LinkedIn campaigns.

Software and tools costs include subscriptions for your CRM, marketing automation, analytics, and other tools. This might be the monthly fees for platforms like HubSpot, Salesforce, or SEMrush.

Content and creative costs involve creating marketing assets, such as work from freelance writers, designers, or video producers. For example, you might pay a freelancer $500 to design a new ad creative.

Overhead includes a portion of general business expenses allocated to sales and marketing. This could be rent or utilities for the office space your marketing team uses.

Overlooking even one of these categories can give you a dangerously low CAC number, creating a false sense of security about your marketing's performance.

The Real-World Consequences of Inaccuracy

Getting your CAC wrong has tangible, negative effects on your business. I've seen it happen. A common mistake is only counting direct ad spend while completely ignoring all the other crucial expenses we just covered.

You might think a campaign is a wild success based on ad platform metrics alone. But once you factor in the salaries of the people running it, the software costs, and general overhead, the picture can change dramatically. This oversight leads to some serious problems:

Bleeding Marketing Budgets: You keep pouring money into channels that are losing you money, draining resources without delivering a positive return.

Stalled Growth: Without accurate data, you can't confidently scale your successful campaigns. You end up hitting a growth ceiling because you're just not sure where to allocate more funds.

Poor Strategic Decisions: Every major business decision, from setting your prices to planning for expansion, is impacted by your acquisition economics. Bad data inevitably leads to bad strategy.

The market has become unforgiving of these kinds of errors. Research shows that customer acquisition costs have surged by an incredible 222% between 2013 and 2025. This dramatic rise is fueled by increasing ad prices and fierce competition. You can explore more about these rising acquisition costs to get a better sense of the market pressures at play.

> A customer acquisition cost calculator isn't just a math tool; it's a strategic compass. It guides your every move, ensuring your growth is not only fast but also sustainable and profitable.

Moving Beyond Simple Math

Thinking of a customer acquisition cost calculator as just a simple formula (Total Costs / New Customers) really misses the point. Its true value is that it forces you to identify and track all the hidden expenses that go into winning a customer. This discipline is what separates the businesses that thrive from those that just struggle along.

It makes you ask the important questions. Are we including a portion of our sales team's salaries? What about the subscription costs for our CRM and marketing automation software? Have we accounted for that freelance designer we hired for our last campaign?

Answering these questions gives you a complete, holistic view of your acquisition engine. It changes CAC from a simple metric into a powerful diagnostic tool, revealing the true efficiency of your entire sales and marketing operation. By embracing this level of detail, you shift from guessing to knowing—and that's a transition that is fundamental to building a resilient, scalable business.

Calculating CAC Without Getting Lost in the Numbers

At its heart, the Customer Acquisition Cost (CAC) formula is straightforward: divide what you spent to get customers by the number of new customers you got. Simple, right? But the real work isn't the division—it's having total confidence in the numbers you're plugging in. Get this wrong, and you're flying blind with a metric that could sink your business.

The most common trap I see people fall into is only counting their direct ad spend. This feels good because the number looks low, but it paints a dangerously optimistic picture. To get a true handle on your CAC, you have to be brutally honest and account for every single dollar that supports your customer acquisition efforts.

Tallying Your Total Acquisition Costs

First things first: you need a comprehensive list of all your expenses over a set period, like a month or a quarter. The key is consistency, as this allows you to spot trends over time. Think of it less as a chore and more as a full-scale audit of your growth engine.

So, what goes into the pot? Your cost calculation should always include these buckets:

Ad Spend: This is the easy one. It’s the total cash you've dropped on platforms like Google Ads, Facebook, LinkedIn, or any other paid channel.

Salaries and Commissions: This is often missed. You have to factor in the salaries of your marketing and sales teams. If an employee splits their time between acquisition and, say, retention, you need to allocate a reasonable percentage of their salary here. And don't forget any sales commissions or bonuses tied to bringing in new business.

Software and Tools: Add up the subscription fees for your CRM, marketing automation software, analytics tools, and anything else your team uses to attract and convert leads.

Creative and Content Costs: Did you pay a freelancer to design ad creative? Or hire a copywriter for your landing pages? Those one-off and recurring costs belong in this calculation.

> Here's a quick litmus test I use: if a cost disappeared tomorrow and it would hurt your ability to bring in new customers, it needs to be in your CAC calculation. This simple check helps you avoid underestimating your true spend.

Accurately Counting New Customers

Once you’ve got your total cost figure, the next piece of the puzzle is counting the number of new customers you acquired during that same period. The word new is critical here—returning customers are fantastic, but they don't count for this specific calculation.

This is where solid tracking is non-negotiable. To do this right and avoid getting lost in a sea of data, you must first master Google Ads conversion tracking to ensure every new customer is attributed to the right campaign and timeframe. Likewise, you need a reliable way to measure performance on other channels. Our guide on using a social media ROI calculator can give you a solid framework for that.

A Practical E-Commerce Example

Let's walk through this with a fictional online store, "Cozy Mugs," and look at their numbers for a single quarter.

Total Ad Spend: $10,000

Marketing Team Salaries (2 people, 50% on acquisition): $15,000

Sales Commissions: $2,500

Software Costs (CRM, Email Tool): $1,500

Freelance Designer for Ads: $1,000

Total Costs: $30,000

In that same quarter, Cozy Mugs brought in 1,000 new customers.

Now, let's do the math:

$30,000 (Total Costs) / 1,000 (New Customers) = $30 CAC

Just like that, Cozy Mugs has a clear, accurate number. They know it costs them $30 to acquire each new customer. This single metric now empowers them to make smarter decisions about everything from marketing budgets to product pricing.

What a Good CAC Looks Like Across Different Industries

One of the questions I hear most often is, "What's a good customer acquisition cost?" The honest answer? It's complicated. There’s no universal number that signals success. Thinking you can apply a global average to your business is like comparing apples to oranges—or, more accurately, a local coffee shop to a global enterprise software company.

A healthy CAC is completely relative. It all comes down to your industry, your specific business model, and, most importantly, the lifetime value (LTV) of your customers. A DTC brand selling unique socks might be thrilled with a $25 CAC. Meanwhile, a B2B SaaS company could be wildly profitable with a $500 CAC. It’s all about context.

Industry Benchmarks and Key Drivers

So, what causes these massive differences? The biggest factors are usually your sales cycle length, product complexity, and how crowded your market is. If you have a long, hands-on sales process, your costs will naturally be higher.

For instance, B2B industries with big-ticket sales and complex deals almost always have higher acquisition costs. The average CAC in a field like Legal Services can hover around $749, while some sectors, like Aerospace & Defense, can see that number climb even higher. This isn't surprising when you consider the intensive, resource-heavy work required to land a single client. On the flip side, an industry like Pharmaceuticals might have a lower CAC, closer to $187, simply due to different market dynamics. You can find more benchmarks for average customer acquisition cost to get a feel for where your business stands.

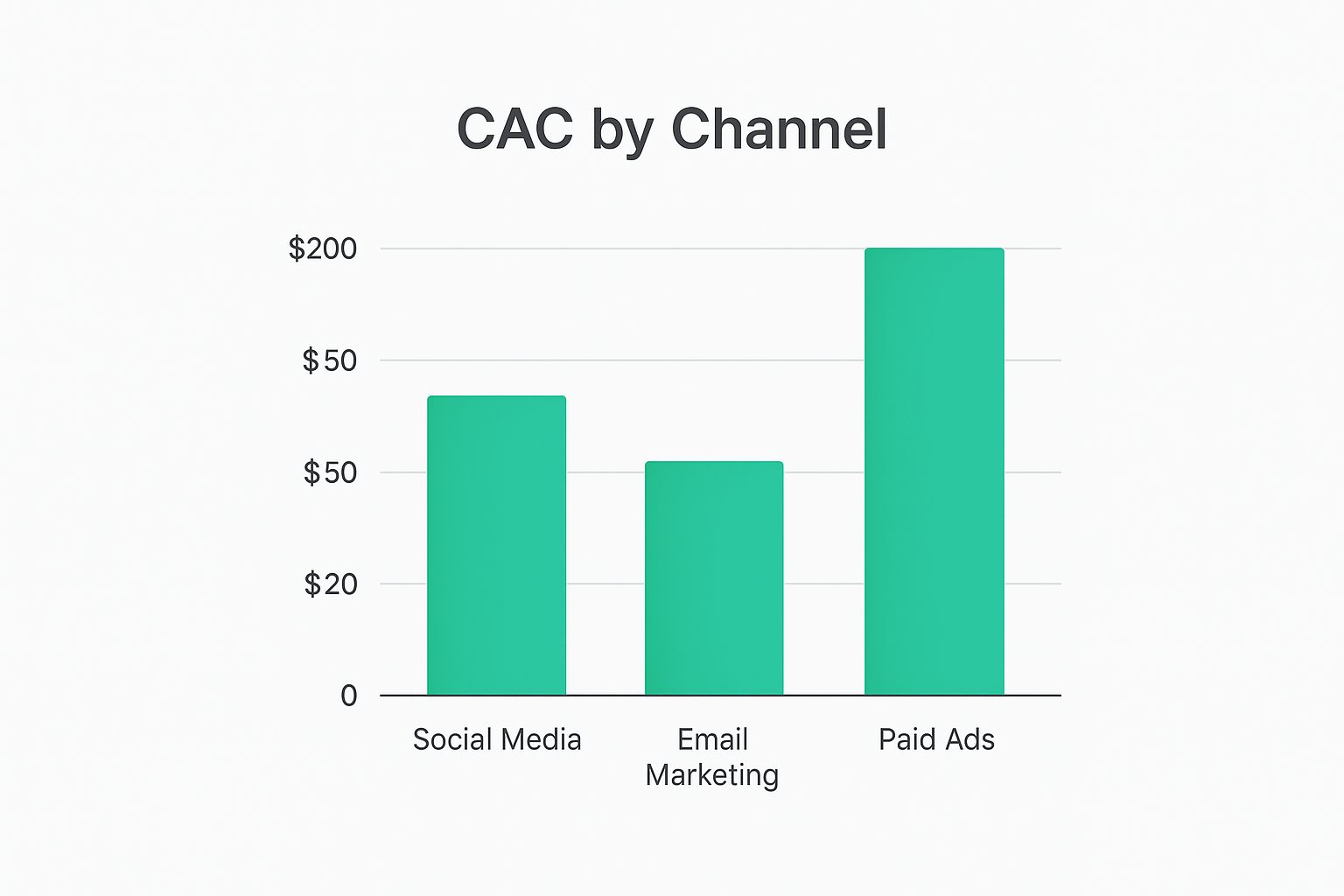

The marketing channels you use also play a huge role in your final CAC. Some are just inherently more cost-effective than others.

As you can see, a targeted channel like Email Marketing often delivers new customers at a fraction of the cost of broad-reach Paid Ads. This is why a smart channel mix is so critical.

To give you a clearer picture, here’s a look at how average acquisition costs can vary across different sectors.

Average Customer Acquisition Cost by Industry

A comparative look at average CAC figures across different B2B and B2C sectors, highlighting the influence of market dynamics.

In the B2B Tech/SaaS industry, the average customer acquisition cost (CAC) ranges from $200 to over $600. This is influenced by long sales cycles, high-value contracts, and the need for extensive lead nurturing.

In e-commerce, the average CAC ranges from $10 to $100. High competition, reliance on paid ads, and lower average order values are the main influencing factors.

In financial services, the average CAC ranges from $175 to $350. This is driven by strong regulation, high customer lifetime value (LTV), and a trust-based sales process.

In the travel industry, the average CAC is between $7 and $90, with seasonality, high competition, and price sensitivity playing significant roles.

In the education sector, the average CAC ranges from $150 to $450, influenced by long decision-making periods, high lifetime value, and multiple stakeholders.

These numbers aren't set in stone, but they show just how much "normal" can differ from one industry to the next.

The Real Litmus Test: The LTV to CAC Ratio

Instead of obsessing over the CAC number in isolation, a much smarter approach is to compare it to your Customer Lifetime Value (LTV). The LTV to CAC ratio is where the magic happens. It directly pits the total revenue a customer will generate against the cost to acquire them, giving you a crystal-clear view of your marketing ROI.

> A widely accepted rule of thumb is to aim for a healthy LTV to CAC ratio of 3:1. In simple terms, this means for every dollar you invest to get a customer, you should expect to get three dollars back over their lifetime with you.

A 1:1 ratio is a major red flag—you're essentially spending a dollar to make a dollar, which isn't a business. Conversely, a ratio of 5:1 or higher is a fantastic sign that your marketing is incredibly efficient, and you should probably be spending more to grow faster.

Here’s a quick guide to interpreting your ratio:

1:1 or less: You're losing money on every acquisition. This is an unsustainable model that needs an immediate overhaul.

2:1: You're profitable, but the margins are thin. There’s little room for error or unexpected market shifts.

3:1: This is the sweet spot for most businesses. It indicates a strong, scalable, and healthy model.

4:1 or higher: You're firing on all cylinders. This is a powerful signal to double down on your most effective acquisition channels.

Ultimately, your customer acquisition cost calculator is just one tool in your financial toolkit. To truly understand your performance, you need to zoom out. Look at industry benchmarks, analyze your channel mix, and, above all, track the long-term value each new customer delivers. This perspective transforms CAC from a simple line item into a strategic lever for sustainable growth.

Navigating the New Rules of Mobile App Acquisition

Getting people to download your mobile app is a completely different beast from finding customers for any other business. The mobile world has its playbook, and you have to understand the rules before you can even start calculating your customer acquisition cost. The journey from a user seeing an ad to opening your app is loaded with unique hurdles and expenses you just don't see anywhere else.

For a long time, the go-to metric was simple: Cost Per Install (CPI). Marketers would spend on ads, watch the install numbers tick up, and consider the job done. But honestly, that mindset is now dangerously outdated. An install isn't a customer. It's just a download. It tells you nothing about whether that person is actually using your app, making purchases, or sticking around for the long haul.

The Privacy Paradigm Shift

The entire game of mobile acquisition was turned on its head by major privacy updates, with Apple’s App Tracking Transparency (ATT) framework leading the charge. This one change fundamentally broke the old model. It made it incredibly difficult for advertisers to track what people were doing across different apps and websites, which was the foundation of most mobile ad strategies.

In the pre-ATT world, you could draw a straight line from a specific ad campaign to an install, making it easy to see what was working. That direct line of sight is gone. It's been replaced by aggregated, delayed data that lacks the detail we used to rely on. This has forced every app marketer to rethink their entire approach from the ground up.

> The new reality is that building a strong brand is just as critical as running direct response ads. You can't just lean on hyper-targeting to scoop up cheap installs anymore. You have to build a brand that people recognize and actively search for in the App Store.

Soaring Costs and New Strategies

This new privacy-focused environment is the main reason acquisition costs have shot through the roof. Recent industry data reveals that the cost to acquire a mobile app customer has jumped by around 60% in the last five years, hitting an average of $29 per new user. You can dig into the detailed research on these rising mobile UA costs to see how market pressures are affecting the industry.

This surge is tied directly to the ad tracking restrictions from iOS and the broader industry shift away from third-party cookies.

To stay competitive, app developers have had to get smarter. Instead of obsessing over CPI, the winning strategies now focus on a more holistic view:

App Store Optimization (ASO): Your App Store page is your new landing page. You need to meticulously optimize your keywords, screenshots, app preview videos, and reviews to capture as much organic traffic as possible.

First-Party Data: The focus has shifted inward. Smart developers are building robust systems to collect and analyze data directly from users inside their app. This is how you truly understand behavior and identify your most valuable users.

Creative Excellence: When you can't rely on precise targeting, your ad creative has to do the heavy lifting. The quality, humor, and appeal of your ads are what will ultimately grab someone's attention in a crowded feed.

At the end of the day, any customer acquisition cost calculator for a mobile app has to look far beyond the initial install. It must factor in the blended cost of all your efforts—paid and organic—and measure your ability to attract users who don't just download, but actually engage, subscribe, or spend.

Proven Strategies to Lower Your Acquisition Costs

Knowing your Customer Acquisition Cost (CAC) is just the starting line. The real game is won by actively driving that number down. This is where you build a truly efficient, profitable, and scalable business—not by blindly cutting your budget, but by making smarter, more targeted investments.

The aim isn't just to throw more money at ads and hope for the best. It's about finding strategies that create sustainable growth. This means fine-tuning the assets you already own, empowering happy customers to become your best advocates, and building channels that deliver value for the long haul. Let's dig into some practical tactics you can start using today.

Improve Your Website Conversion Rate

Think of your website as the final handshake that closes the deal. It’s often the last hurdle a potential customer faces, and even a tiny improvement here can have a massive effect on your CAC. If you double your website’s conversion rate, you effectively cut your acquisition cost in half without spending a single extra cent on advertising.

Start by looking at how people behave on your key landing pages. Where are they leaving? Is your call-to-action (CTA) obvious and compelling? A/B testing different headlines, button colors, and layouts can uncover some seriously powerful insights. Also, make sure your site is fast and works flawlessly on mobile—these are basic expectations that can make or break a user's decision to stick around.

> Your website is your best salesperson, working 24/7. A confusing or slow site is like a salesperson who mumbles and can't find their pen. One small tweak can be the difference between a lost lead and a loyal customer.

Build a Powerful Customer Referral Engine

Your happiest customers are, without a doubt, your most credible and cost-effective marketing channel. A recommendation from a trusted friend will always be more persuasive than any ad you can run. The problem is, too many businesses simply hope for referrals instead of building a system to generate them.

Put a formal referral program in place that gives a little something to both the person referring and the new customer they bring in. The reward doesn’t have to be cash; it could be a discount, store credit, or early access to new products. The most important part is to make sharing incredibly easy. Give them a unique link and pre-written messages they can post on social media or email to friends in just a few clicks.

Invest in Long-Term Content Marketing

Paid ads get you results right away, but you’re essentially renting an audience. The second you turn off the spending, the traffic disappears. Content marketing, on the other hand, is about building a valuable asset that generates organic traffic and leads for years. It's a long-term strategy that systematically reduces your dependency on pricey paid channels.

Focus on creating genuinely helpful content that solves your ideal customer's problems. This could be:

In-depth blog posts that rank for keywords your audience is searching for.

How-to guides and tutorials that position you as an expert and build trust.

Free tools or templates that offer real utility and capture leads in the process.

This approach builds a library of resources that continuously attracts new prospects through search engines and social sharing, lowering your blended CAC over time. As you refine your marketing channels, understanding their financial impact is crucial. You can dive deeper into tracking the returns by learning more about social media ROI measurement. A huge piece of this puzzle is optimizing your sales funnel, as plugging leaks in your process is one of the most direct ways to slash acquisition costs.

Unpacking the Nuances of Your CAC Calculation

Even with a handy calculator, moving from the theory of CAC to calculating it for your own business brings up a lot of practical questions. It's normal. These are the "on-the-ground" details that can make or break the accuracy of your numbers. Let's tackle some of the most common sticking points I see business owners run into.

How Often Should I Calculate CAC?

One of the first things people ask is about timing. How often should you be crunching these numbers?

For most businesses, a monthly and quarterly cadence is the sweet spot. A monthly check gives you a tight feedback loop on specific campaigns or channel experiments, letting you pivot quickly if something isn't working. Then, the quarterly calculation smooths out any of those single-month anomalies, giving you a more stable, big-picture look at your marketing engine's health. The most important thing is just to be consistent so you can spot trends over time.

Wait, Do I Need to Include Salaries?

Yes, absolutely. This is probably the single most important—and most often forgotten—part of getting an honest CAC figure. If you only count your direct ad spend, you're not getting the full story, and that can lead to some really poor decisions down the line.

Your true acquisition cost has to include a portion of the salaries for anyone involved in bringing in those new customers. Think about your sales and marketing teams.

Base salaries and wages

Sales commissions

Performance bonuses

If an employee isn't 100% focused on acquisition (maybe they also handle retention or customer support), you'll want to allocate a percentage of their salary that reflects the time they spend on new customer activities. Skipping this step gives you a dangerously optimistic number and a false sense of profitability.

What’s a Good LTV to CAC Ratio Anyway?

A "good" CAC is completely relative. A $100 CAC might be a steal for a SaaS company selling enterprise software, but a disaster for an e-commerce brand selling $25 t-shirts. This is precisely why the LTV-to-CAC ratio is the metric that truly matters. It contextualizes your spending by showing you the long-term return.

> The gold standard for a healthy LTV-to-CAC ratio is widely considered to be 3:1. In simple terms, this means for every dollar you spend to acquire a customer, you can expect to get $3 back over their lifetime with your business.

If your ratio is 1:1, you're essentially losing money once you factor in the cost of goods sold. You're on a treadmill to nowhere. On the flip side, a ratio of 4:1 or even 5:1 is fantastic. It's a strong signal that your marketing is incredibly efficient, and you probably have a green light to spend more aggressively to fuel growth.

While 3:1 is a solid benchmark, remember that the ideal number can shift based on your industry, business model, and growth stage. These are the kinds of vital metrics you need for accurately measuring social media success and proving the real ROI of your efforts.

Ready to grow your Instagram followers with real, engaged followers? Gainsty uses advanced AI and expert strategies to connect you with an authentic audience, risk-free. Stop guessing and start growing today at https://www.gainsty.com.

.png&w=1920&q=75&dpl=dpl_8YjY2AdZtmqizmVC1J4YDDwBcdzb)

.png&w=750&q=75&dpl=dpl_8YjY2AdZtmqizmVC1J4YDDwBcdzb)